Grade 5 Lesson 1: #SMART #FinancialGoals

Today, we start our #shortlessons for grade 5. In grade 3, we introduced the concept of #financialgoals. Financial goals are the personal objectives you set for how you’ll #save and #spend #money. They can be things you hope to achieve in the short term or further down the road. See that short lesson here: Grade 3 Financial Goals Lesson

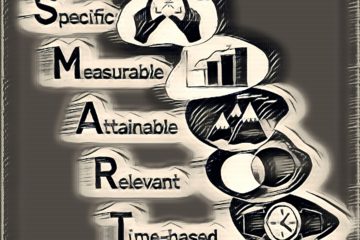

Financial goals are a highly involved topic and there are several frameworks for goal setting. One such framework is the SMART framework. The SMART system is essentially steps you can take to achieve your financial goals more effectively. SMART stands for #Specific, #Measurable, #Attainable, #Relevant, and #TimeBound.

- Specific: You need to be as specific and concrete when setting your goals. A simple example: instead of planning to “#save most of my #allowance”, one should think about “#saving half of 60% of my allowance and putting it into my savings account”. The next step of specificity is to draw up a detailed #budget that shows how the funding flow would look like weekly or monthly, where the #money would come from, spending etc.

- Measurable: Always put a number to your goals. Qualifiers like “most” are too generic. Putting actual numbers in either #currency (e.g., $$, INR, etc.) or in percentages should be done.

- Attainable: Having lofty, unattainable financial goals can be very frustrating. E.g., if my allowance is $50/month, then expecting to save $1000 in 6 months is not possible and can often lead to disappointment. Your prior allowances, #earnings, and #spending habits are the best indicators of what is realistic. If you want to aim for lofty goals, have 2 different goals – a “base” goal (which is attainable) and a “stretch” goal.

- Relevant: This is probably the most important part of our SMART framework. Kids should ask themselves the question – why am I going after this goal? Should I do it? How will it help me? How will it make me feel? Parents should also help kids think through the relevance of the goal before they get started. This is the part of the framework where complete alignment needs to happen between the financial goals and personal values.

- Time-bound: Setting a period for your goals is very critical. Starting date/time and when will be completed. As the goal progresses, one should be flexible and make any adjustments. But starting with a timeframe is important.

Note that the SMART framework is not just relevant to kids. It is highly relevant to adults as well. Next time, when you are setting a financial goal, try out the SMART framework.

ayu ecosystem #kids #education #financialliteracy