Grade 9 Lesson 6: #Renting or #Leasing a #Home

Renting (also called leasing) #property is where someone pays money to use property (such as a home, office, land, etc.) for a finite amount of time. The document that has all the details written on it is called the #lease. The person who owns the property that will be leased or rented is called the #lessor. The person who is paying the money to use the property is called the #lessee or #tenant.

Having a Home is a basic function of every human society. Everyone needs #housing of some kind. A housing unit, or home, is the place where people carry on the private activities of their lives. Home is where people eat and sleep, where they store their belongings, and where they can mingle undisturbed with members of their families.

Most people either buy a house or #rent it. Buying a home can be quite complex and expensive since there are a lot of steps one must go through such as #appraising the property, #mortgages, #maintenance, #propertytaxes, etc. Renting typically is much simpler. There is no #mortgage to arrange, no need to prorate property #taxes or #insurance payments between the old and the new tenant, and, in most cases, no need to enter the #transaction in public records as must be done when a building is sold. Renting also gives you the flexibility of moving to a different home, city, or even country without worrying about any fixed assets you may have.

The downside to renting is that you are not building an #asset. Other downsides include the landlord increasing rent, the landlord evicting you, and the landlord not allowing you to make any desired changes to the rented house.

So it is better to buy or rent?

Owning vs. Renting is one of the most debated topics when it comes to property. Several financial models have been built comparing the two and there isn’t a right answer. Or a wrong answer.

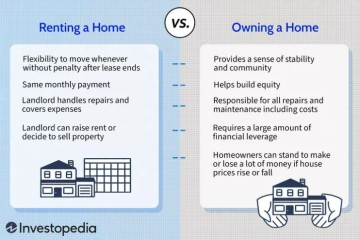

Below are some points to consider as you think about owning vs. renting:

• Whether you choose to rent or buy your home depends on your financial situation, lifestyle, and personal goals.

• Both provide you with a place to live and require regular income to make the payments.

• Renting offers flexibility, predictable monthly expenses, and someone to handle repairs.

• Homeownership brings intangible benefits, such as a sense of stability and pride of ownership, along with tangible ones of tax deductions and equity.

• Renting doesn't mean you’re throwing away money every month, and owning doesn't always help you build wealth in the long run.

Thank you @Investopedia for a simple, yet powerful graphic comparing the two

ayu ecosystem #kids #education #financialliteracy #finance