Needs are #expenditures that are #essential for you to be able to live and work....

A Learning Ecosystem powered by our Community

ayu is a passion project. When we started to introduce concepts like savings vs. spending vs. investing vs. giving back to our 8-year-old, he started to respond well. We did not give him a traditional “piggy bank” – instead we created a simple digital piggy bank for him on our laptop. He had the option of spending, saving, or giving back with the digital money in his digital piggy bank. We started to see that he would track and manage his digital piggy bank smartly and diligently.

This is how ayu was born.

Our goal is to build an ecosystem that introduces and enables financial literacy and money management for kids. We have seen so many examples of generations of families that lead a debt-ridden life. In most cases, the parents don’t have the necessary financial literacy to teach their kids. Financial literacy is not taught in schools. So, for the most part, kids are unable to learn this very important subject and thus break out of the “debt cycle”. This is what we aspire to fix.

Our vision is to enable our holders to learn, spend, save, invest and give back directly on our ayu platform.

Join us on our journey...

Needs are #expenditures that are #essential for you to be able to live and work....

Money is something (such as #coins or #bills) that is used to buy #goods and #services and to #pay #people....

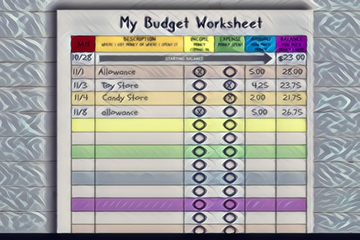

One thing that all of us should do is #create and #manage a #budget. A budget is a means of keeping track....

#Saving is when you take a portion of you what you earn, and instead of #spending it now....

Income is #money that someone gets for doing #work. Most commonly, it is money that is paid by an #employer....

It is important for kids to understand what borrowing and debt mean early in their lives. An easy way to explain this to #kids....

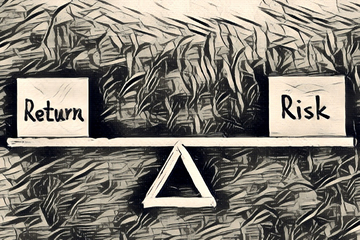

It is never too early to begin learning the concept of risk. Risk is any situation that exposes someone to danger....

Standard of living refers to the #quality and #quantity of #goods and #services available....

Currency is the official #money of a country. Typically, it consists of #papermoney and #coins. Each country....

In the most basic sense, a career is a #job that one dedicates their life to do. Examples of a career are a #lawyer, #firefighter....

#Borrowing, #Trading, and #Gifting are 3 key, inter-related concepts when it comes to #financialliteracy....

#risk vs. #return is a key concept in #finance and #investing. At the most basic level, this concept states that....

Financial goals are the personal objectives you set for how you’ll #save and #spend #money....

Saving is when you take some potion of what you #earn, don't #spend it today, but set it aside for the future....

It is now time to explain different forms of #payments to #kids. By this time, all kids are familiar with the concept of #money....

#Credit #cards are used widely. #Kids see their parents use credit cards daily, and they will often have questions....

Broadly, there are several different ways you can #earn or get #money. Some you have to work for....

Assets are things that we own and can be sold to get money. Another way to think about assets is that....

A liability is something a person owes, usually a sum of #money. In other words, when you borrow money from someone....

Insurance is something that protects you #financially against a #loss. This means that if something goes wrong....

There are several types of insurance like Home, Auto, Life, Health, Liability, Property etc....

Interest is a very important concept to understand in #finance. The simplest way to understand interest is....

In the most basic sense, #compound #interest means interest on interest. If you leave your money in the #bank....

A credit score, at the most basic level, is a measure of a person's #Creditworthiness. Creditworthiness is how....

A credit #report is a detailed summary of an individual's #credithistory. Such a report has your personal information....

Financial goals are a highly involved topic and there are several frameworks for goal setting. One framework is the SMART...

Unearned income is income not acquired through working, doing a job and doing your own business...

Taxes are mandatory monies that a government gets from its citizens. This money is then used...

There are several different taxes and each of these taxes form a “revenue-stream” for the government....

A Resume is a written summary of qualifications, skills and work-related experience of an individual....

A contract is an #agreement describing certain obligations binding two or more #parties.....

Marketing refers to all activities that an organization or individual does to promote and sell products or services...

Expenses refer to the money you need to pay for stuff that you buy and use. There are 4 types of expenses...

A loan is a type of #debt. A borrower borrows a sum of #money (called the loan) from the lender...

Broadly loans are classified as either Secured or Unsecured loans. Examples of loans: Auto, Home, Personal...

We will learn about the different types of debt. Debt is often broken down into two buckets: “Bad” debt and “Good” debt...

Identity theft is when a person (let's call him John) “#steals” another person’s identity (let's call him Tim)...

At the most basic level, the economy is the part of our society that deals with the creation and use of wealth..

Supply and Demand are two of the most basic pillars of how an economy works. Supply of a product is ..

Inflation, in its most basic sense, is a rise in prices. For instance, a baseball bat that cost $20 two years ago may now cost $25..

Time value of money simply means that a #dollar or a #rupee (or any other currency) received today is worth more...

Future value is the value of your money at some point in the future based on an assumed #growth rate. ...

The stock market is a place where people buy and sell #shares, or little parts of #companies. Companies offer....

A stock is a #share in the ownership of a company. Buying shares or stocks means you’re investing money in a #company...

Bonds, an important #investment instrument, are basically #loans that the “#buyer” makes to a #company or...

A #mutual #fund is a kind of #investment that uses #money from #investors to #invest in #stocks, #bonds,...

#Fixed #deposits (also called #term deposits or #certificate of #deposit #accounts) is an #investment instrument...

Real estate #investing uses #real #estate properties (such as a house or an office) as an #investment vehicle....

Cryptocurrency is a #digital currency. It uses digital files as #money. It has no physical presence....

We begin our #shortlessons for the 9th grade with a topic – what are the different ways to make money?...

Whenever we have to make a decision or make a choice, there is something lost. If we...

Giving back means devoting your time and efforts to those who are less fortunate than you...

Cost of living is defined as the amount of #money required to cover necessary #expenses to maintain a certain #lifestyle...

Retirement refers to the time in one’s life when s/he chooses to permanently leave the #workforce i.e. stop #working...

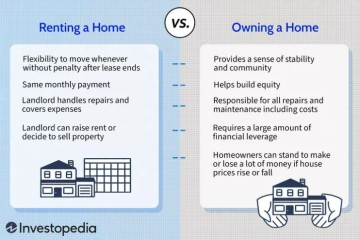

Renting (also called leasing) #property is where someone pays money to use property for a finite amount of time...

Banks are like your own personal money butler, here to keep your cash safe and sound, and to offer you....

A currency is like magic #money that a country makes. Each country has its own kind of magic money, like....

The stock market is like a big store where people buy and sell shares of companies. Each share represents...

Recession is a term used to describe a period of time when the economy of a country is not doing well...

An emergency fund is an important tool for financial security and peace of mind. By understanding what a ...

For anyone looking to go to college or university, it's important to understand how you're going to pay for your education...

A mortgage is a type of loan that you can take out to buy a house, and it's important to understand....

Investing can be a great way to grow your wealth over time, but it can also be risky if you....

When it comes to managing your money, it's important to make informed decisions that will help you achieve your financial goals....

When it comes to understanding the economy of a country, two important concepts to be aware of are.....

Investment analysis is a process of evaluating investments to determine whether they are worth putting.....

Technical and Fundamental Analysis are approaches used in analyzing financial markets to make informed investment...

When you invest in equities, you're buying a share of the company's stock, which means you own a small....

Several factors that could impact your equity investments: market cycles, market efficiency, and market volatility.....

Equity trading is the buying and selling of stocks or shares of a company on a stock exchange with the aim of making a profit.....

There are several key metrics and ratios to consider when investing in equities. These metrics.....

Derivatives are financial instruments whose value is derived from an underlying asset, such as stocks, bonds.....

Options contracts are a type of derivative that grant the holder the right, but not the obligation.....

Financial literacy refers to the knowledge and skills necessary to understand and manage your finances effectively...

In this lesson we will delve into key topics such as saving, spending, earning, investing, and giving....

In this lesson, we explore the fundamentals of budgeting and how it helps manage earnings and expenses effectively..

In this lesson, we will explore the fundamentals of debt, its types, the distinction between good and bad debt etc..

In this lesson, we will explore the fundamentals of banking, including various banking services..

Understanding the concept of simple and compound interest, particularly the latter, is a crucial aspect of financial literacy...

Investing is an essential aspect of financial literacy that can help you build wealth and achieve your long-term financial goals...

Risk refers to the uncertainty or potential for loss associated with an investment. It is an integral part of any investment decision..

In the realm of personal finance, assets are valuable resources or possessions that have economic value...

Insurance is a financial arrangement that provides protection against potential losses. When unforeseen events disrupt...

Taxes, often deemed compulsory contributions, constitute the lifeblood of governmental operations....

A loan, often referred to as a form of debt, entails a borrower receiving a specific sum of money....

The term "Economy" often pops up in conversations, especially during discussions about financial matters....

Investing is like planting seeds for a bountiful harvest. It involves putting your money to work to generate more money....

Have you ever wondered why some people seem to effortlessly accumulate wealth while others struggle to make ends meet?

The concepts of financial independence, the FIRE movement, and retirement may seem distant for some, but they....

Two of the most crucial concepts in investment strategy are diversification and asset allocation....

Focuses on portfolio construction, asset allocation, and investment examples tailored to the unique needs....

Fixed-income investments, such as bonds and fixed deposits, offer a stable and predictable way to grow your wealth...

Investing in equities, often referred to as stocks or shares, has been a primary avenue for building wealth....

Investing in real estate, whether it's residential, commercial, or other types of properties, has been a time-tested path....

Fixed deposits (FDs), also known as term deposits or certificate of deposit accounts, stand as stalwart investment instruments....

In addition to fixed deposits and bonds, India offers several other fixed income investment options...

Futures and Options contracts are agreements between two parties to buy or sell an asset at a specified price...

As you embark on your financial journey, it's essential to lay a strong foundation for your financial well-being. ...

Meet Raj, a person who has achieved what many consider impossible in our country—a journey towards financial independence...

Focusing on key metrics, performance analysis, and practical considerations when selecting mutual funds and ETFs...

As you embark on your investment journey, understanding key concepts/terms such as NAV, alpha, beta, expense ratio...

Rahul, who has meticulously crafted his financial strategy, now enjoys the luxury of living on a passive income ranging from....

Portfolio Management Services, commonly known as PMS, is a customized investment service provided by....

Let's understand why strategies like Systematic Investment Plans and lump-sum investments during market dips....

Join us in this immersive exploration as we follow the financial journey of Raj, a young professional working in the....